New Year, and about darn time for a new guest blog!

As we start the New Year bright-eyed and hopeful, we often include monetary or financial goals on our Vision Boards, journals, and as part of our New Year’s resolutions. We have the best of intentions, but without proper knowledge and planning, these goals quickly dwindle and mar the year’s success.

I know my Vision Board and journal are littered with financial goals, fortunately I was taught money management at home, from a young age. Growing up, both of my parents struggled. Not because they weren’t good with money, but because they had a lot of responsibilities. My parents divorced about the time my mom went back to college, so she was working full time, going to school part time, co-parenting a wonderful child (I was the easy part of the equation), and doing it on one income. While my family came together to make sure I had every experience and opportunity that the kids around me did, I would never label my childhood as luxurious. Which, in hindsight I’m thankful for. I watched them grapple, manage, and adapt, when it came to money.

My awareness and knowledge about money grew tremendously through their crash courses in business. First, as I donned my 4-H regalia, and later as they supported and advised me through the purchase of a small cow herd at the ripe age of 17 with no job, and headed off to college… I can also vividly remember being 16, working for mom, and writing the checks and filling in her monthly budget. It was through these experiences, and their constant coaching, that money became more than a piece of paper or a plastic card. It was often a source of stress in our home, later becoming a source of security and giving.

While I can’t loan my parents out to give you personal money management tutoring, I’ve enlisted my personal CPA to give some money guidelines that, if followed, will give you more than just this year’s success with money. Oh, and this CPA? She’s a badass. She came from a poverty-stricken childhood (real shit, think: living in a cabin with no indoor plumbing or electricity as a kid…), and has become a well-respected CPA and part-time CFO, managing her own business, owning her dream home and multiple properties, all while lifting others up as she raises to the top. (Oh, I would also like to mention, she has a witty and stunning daughter.)

Yep, this gal is my MOM.

Take it away mother –

Money, moolah, greenbacks.

Cash, checks, credit cards, debit cards.

The almighty dollar.

It makes the world go around, and people lie, cheat, steal and kill for it. It is one of the leading causes of insomnia, and one of the top three causes of divorce in the United States. With something this powerful, don’t you think it makes sense to learn how to control it?

The answer is yes – you must be able to control your money. The amount you make, the amount you spend, the amount you save, and most importantly, the amount you owe. You need to be able to control your money so it doesn’t end up controlling you and your life. Ironically, this is something that receives little attention and guidance from an education perspective. Ideally you will learn these principles as you are growing up from your parents. However, many adults don’t have these skills so it is impossible for them to pass them on to their children. In the age of “I want it all, and I want it right now” (as Queen put it, God rest his soul), saving has gone out the window.

In come the credit cards! No longer do people save up to purchase things. Instead, they do it backwards; they purchase and then are committed to paying for it after the fact. The newness wares off, and about that time so does your incentive to make more than the minimum payments. In fact, you are often already planning your next purchase.

With the cost of living going up and many young people swimming in a pool of student loan debt, the challenges are different than they were 20 years ago. Looking back, life made more sense when you couldn’t get a credit card with no credit and an insufficient income. What a novel concept! Seriously, how much sense does it make to borrow money to pay for something you can’t afford, and then pay twice as much for it after interest and the occasional late penalty fees? Now, you are even more broke because you have added another monthly expense and thus have less money to pay for the necessities. So you start using the credit cards for things you have to have, like fuel.

So, how do you control your money? The first step is to set up a budget. Be a Bob, aka “baller on a budget”. It doesn’t have to be fancy, a piece of paper with the amount of your monthly fixed expenses will do. By fixed expenses, I’m talking about rent, utilities, food, insurance, prescriptions and any loan payments. Gas should be on there too but you do have a little flexibility when it comes to how much you are driving. Next, add up your income sources. This could be from work, support from family, and student loan proceeds. If your expenses are more, than you have to make immediate changes! If you have some left over, that is the amount you can use for savings, eating out, and clothes. In my leanest of times, I went a year without buying a new pair of jeans. And I survived to tell about it!

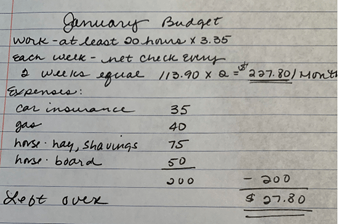

I started my first real job at 15 years old, and saved my money to purchase my first horse a few months before I turned 16. Enter the budget! I had a little spiral notebook that was on index card paper and was only about 5×5. By this time in my life, I was responsible for all of my spending other than paying for my housing. I had to buy all my own clothes, lunches, medical bills and most of my food. Luckily for me, I worked at a seafood restaurant and could eat the inexpensive items on the menu.

Here is what one of my earliest budgets looked like:

Each month, I copied the prior months numbers and compared my budget to actual to see if I was on track. You may look at this and think it’s silly to spend so much on a horse, right? Well, I was 16 and that was the main reason I worked. It was the most important thing in my life and I chose to work instead of sports and school activities. As I got older and could afford a little pickup truck and my own place, the amounts obviously changed. The earnings grew when I obtained a skill set that paid more than minimum wage. The expenses grew in dollar and types. You need to remember two things about budgets: they aren’t helpful if you don’t update them, and they aren’t helping you if you don’t compare the budget amounts to actual paid to see if you are accurately budgeting or overspending. Having a budget isn’t about depriving yourself of what you want. It’s the opposite; a budget is the tool we have to help us prioritize what we want to spend our hard-earned money on, and what we need to earn to allow us to do that. It helps us set earnings goals, too. In short, it lets us have control over our money.

Remember, you have to pay all your bills on your list of fixed expenses before you spend a penny on other things. I’d suggest setting aside your food and gas money based on a weekly allowance. Food is a moving target and one of our greatest expenses – it’s kind of important! If you can’t eat and maintain your health, you can’t work, and before you know it things are going to hell in a hand basket. That being said, you really can save a lot of money if you are conscious about what you are buying. Growing up, I drank water. Period. It was a treat to have Kool-aid. No sodas, no juice boxes. Bottled drinks are very costly and honestly, you can do without them. Or at least purchase sparingly. I’d also suggest buying a coffee pot and whatever deliciousness you like to have in your coffee, and make it at home! They sell the paper cups with the plastic lids so you can even pretend you bought it and no one would know it was made at home. Pack your lunch! You’ll find that you eat healthier and the amount you can save on buying lunch is staggering. In fact, you can practically buy enough food for the whole day (all three meals) on what one lunch out will cost you. Make sure you have a grocery list when you go to the store and don’t go when you are hungry. Both these steps will help you to avoid purchasing more than your budget allows.

When you are looking at buying something you really don’t need (you need to understand the difference between need and want here) consider how many hours you’d have to work to pay for it. If you make $25 per hour and are lucky to clear $20 per hour (after taxes), and you are looking at something that cost $160, ask yourself: is this worth a full day of working? I think you’ll be surprised at how that changes the feeling you have when you lay down those greenbacks on the counter.

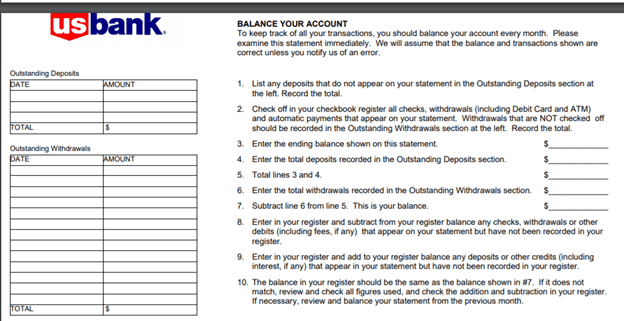

Next, learn how to balance your checkbook. You’ll most likely be writing checks for most of your fixed monthly expenses (if you’re paying bills online, you can still keep a record of spends either on your budget or in a check register). Do you get a paper statement from the bank? Have you ever flipped it over and looked on the back? Check this out:

It’s like a fun crossword puzzle for geeks! You compare what the bank says to what your check register says. Consider this scenario – you are going off the balance the online banking says you have. It shows you have $250 in your account. Awesome. It’s Friday night and you’re going out to party! You don’t realize that the $175 you mailed off for your utilities and phone bill is still being processed by the bank and they haven’t deducted it yet. So you really only have $75 and it has to last you a week’s worth of groceries and gas. Since you don’t realize this, you are feeling like a hot deal, and buy everyone drinks. You spend $50. You look at your account online the following Tuesday and your stomach drops to the floor because you only have $25 left, an empty tank of gas, and the only thing in your fridge is a half dozen eggs and an onion… plus some other gross stuff you need to clean out. You end up with onion breath, a gassy stomach from eggs, and blisters on your feet because you had to walk to work or the bus stop.

Does that budget and balance sheet feel important now?

I’ll wrap this up with one last thought. Consider your peers and friends who are a little more fortunate than yourself when it comes to having cool things. They have the nice car, new clothes, and eat lunch out every day. Money is something they don’t worry about, they just spend. They have no budget and they don’t value the dollar. They are young, carefree, and just loving life. Fast forward 10 years. They have been struggling to maintain the lifestyle they grew to expect while they were teenagers and young adults. However, they are now working at a medium paying job and have amassed a mountain of credit card debt. 25% of their take-home pay is going to credit card minimum payments. They don’t have enough disposable income to qualify to buy a home or even a new car! They have dug a hole they will most likely never get out of unless they declare bankruptcy. And guess what? Many of the people I have seen declare bankruptcy are back in the same spot within ten years. It’s all about a mindset and being aware of how incredibly powerful money is. Don’t let it get the best of you!

Thanks mom! Your support and advice has given me a leg up on life, and I just don’t know what I’d do without you. Thanks for hopping on the blog, you da bomb.

I hope you all love my mom as much as I do (how freaking lucky am I?!), and took something helpful away from her post. Now, cheers to a prosperous year, and abundant success!